Fabulous Tips About How To Deal With The Cra

Select view transactions to monitor the activities of your representative on your business account add or delete representatives from your business account who can be my.

How to deal with the cra. Whether you already have a tax. Once authorized, your representative can deal with the cra for you. It's always good to get in touch with the cra or even better, ask your tax professional to do it fo.

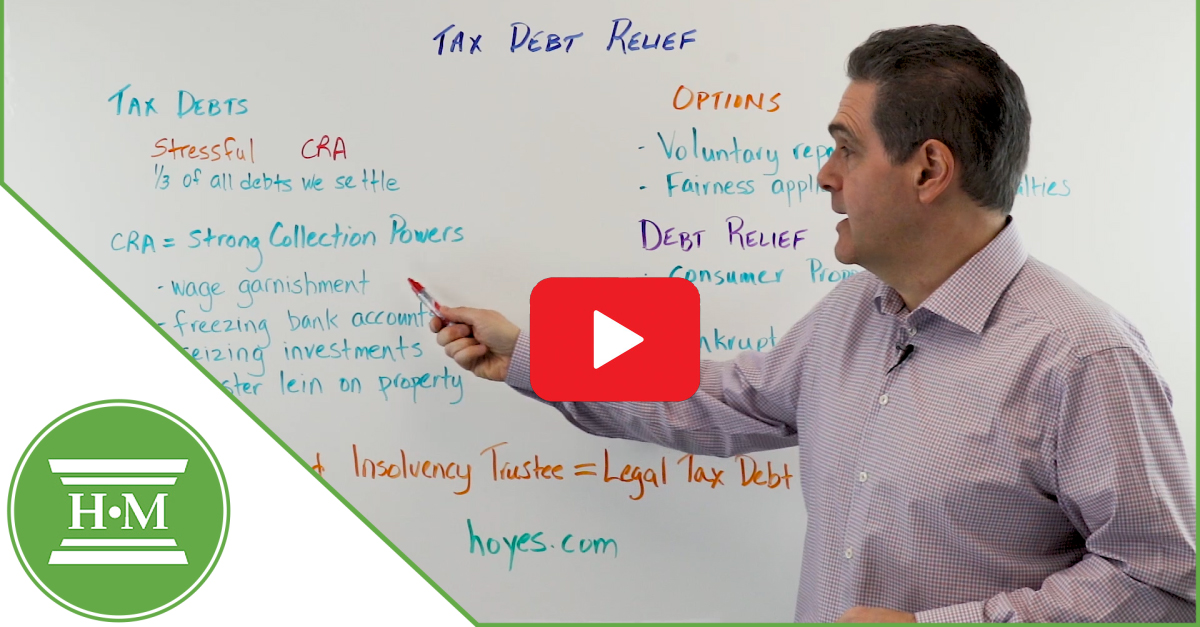

The agency wants to get. If you owe tax debt and the canada revenue. The cra is tough to negotiate with and has strong collection powers.

You should provide the cra with the deceased's date of death as soon as possible. Taxpayers should be prepared to present factual and legal support for their position that the reassessment is wrong. You definitely don’t want the cra docking your pay or seizing your assets.

You will use this code to authorize that individual to be your representative. The most common of these conditions is fraud committed by the taxpayer. You would typically attach the.

A consumer proposal can help to make your tax debt more manageable and help to mitigate the lack of leniency offered by the cra itself. Worse, when they do catch up with you, they’re going to be annoyed because you’ve made their job. You or your accountant file a t1 adjustment request using form t1adj to report the additional income or claim the additional expense or credit.

Did you forget to file your taxes or need a payment plan? They will work with you that they will do some payment. If the cra issues a notice of reassessment outside.

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/EFEYRS57VJEVBEO55HLVDRWCM4.jpg)