Unbelievable Info About How To Build Emergency Fund

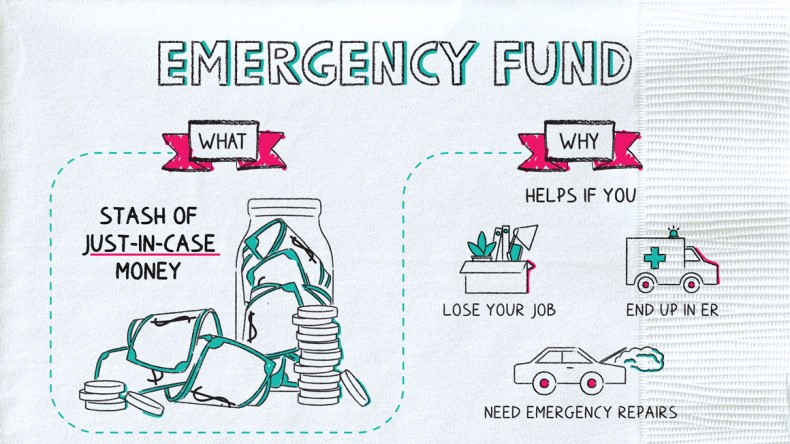

Record your monthly household expenses and categorize them into obligatory and discretionary.

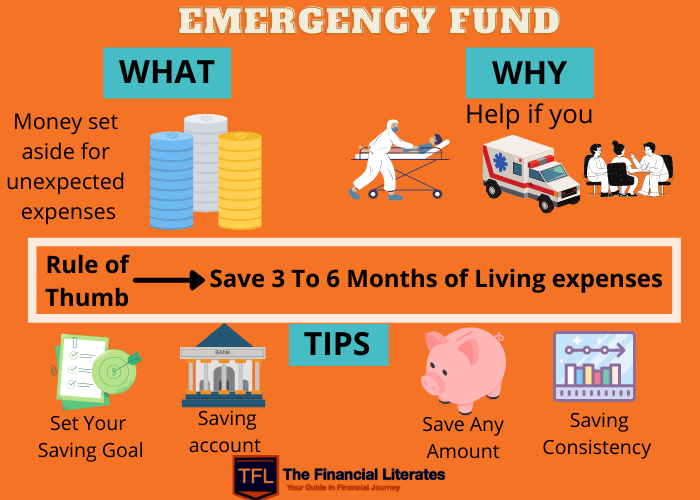

How to build emergency fund. Many people are not aware of how important it is to have an emergency fund. 5) review and reorganize your budget on a regular basis. Despite how important a financial cushion is, building one can be.

The first step is to determine how much you spend each month. Determine the amount you need. Approach this effort the same way you would approach any other financial goal.

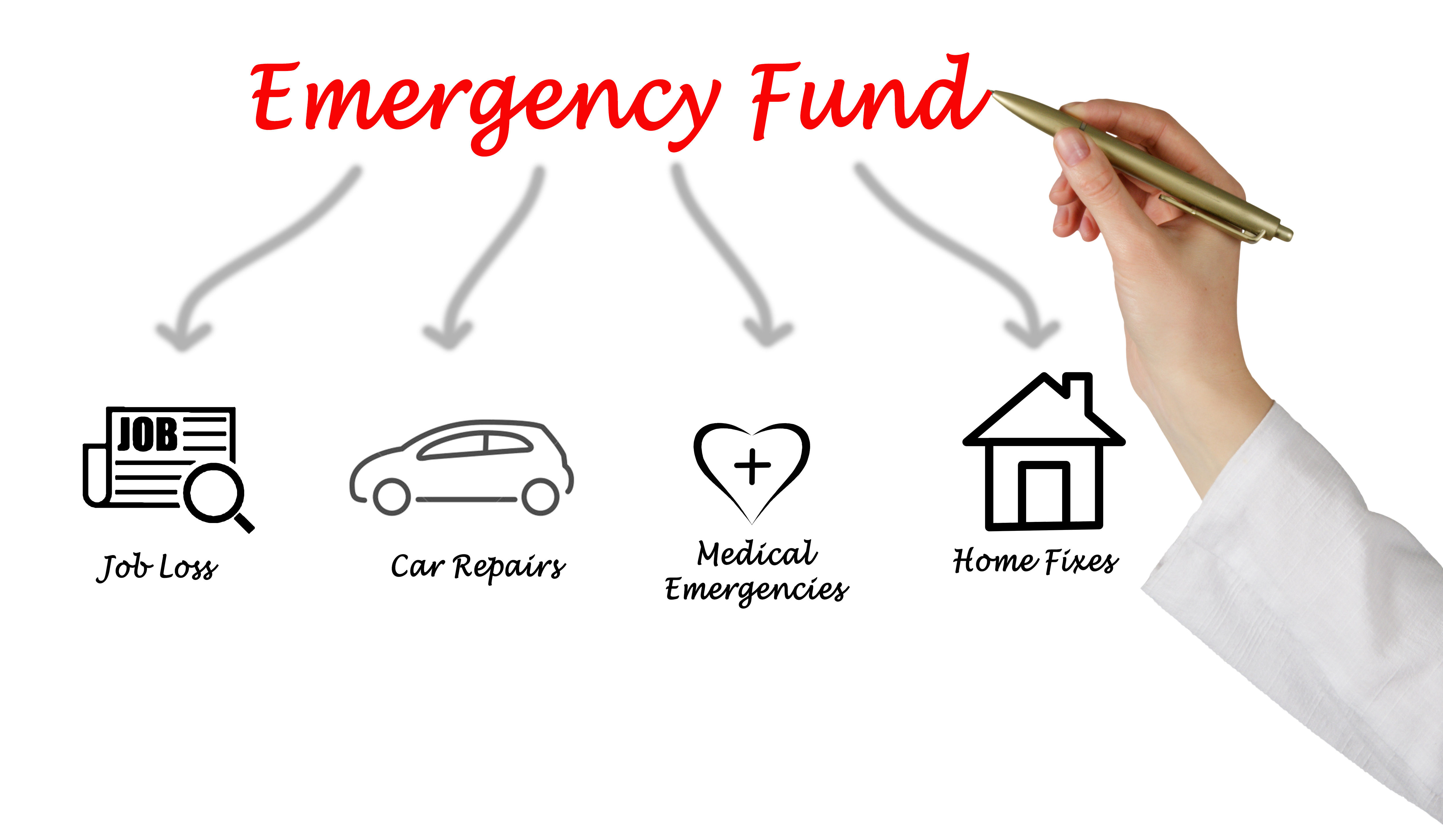

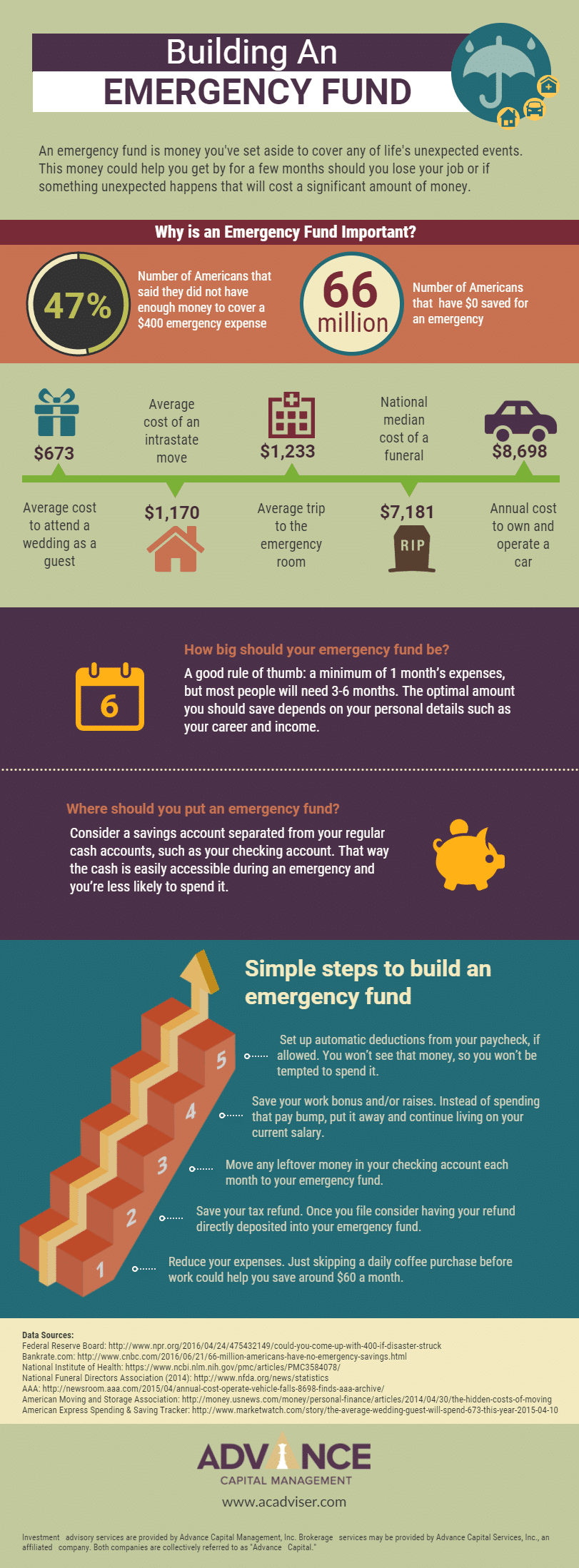

Whether your work situation changes, or you expecting a. That way when minor emergencies arise, you’ll already have some money set. An emergency fund allows you to pay for car repairs, unplanned medical bills, and when you're unemployed.

Create a separate emergency savings account. Start by looking at your monthly expenses and determining how much money you would need to cover these. The cfpb recommends setting up a separate savings account for your emergency fund.

With that perspective in mind, let’s consider how to save for an emergency fund. Write down your monthly income and expenses to find out how much you need every month for your. How do i build an emergency fund?

How to build an emergency fund in 7 steps 1. The best place to keep your healthcare emergency fund is in a health savings account. Set up recurring weekly or monthly deposits into your emergency account so you can easily build the habit of saving,” says moore.

![Emergency Fund: The Definitive Guide [New Perspective] - Getmoneyrich](https://getmoneyrich.com/wp-content/uploads/2010/01/Emergency-Fund-Flow-Chart6.png)